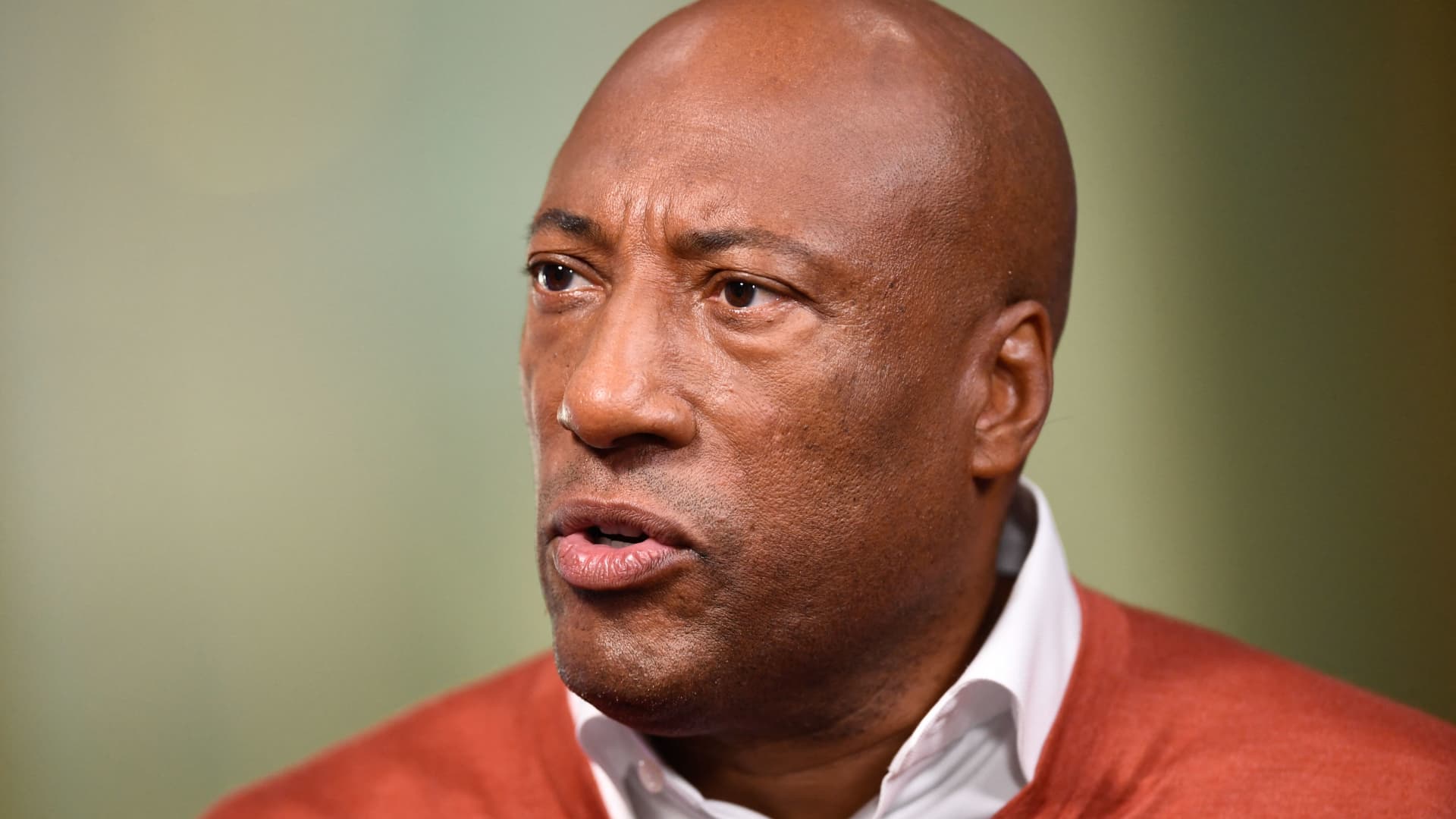

Jim Farley, Ford CEO

Ford

DETROIT – Ford Motor CEO Jim Farley is promising something Wall Street has been asking from the storied American car manufacturer for years: A clear and decisive plan as the auto industry transitions to electric vehicles.

In the coming months, Farley said he “will lay out the entire picture” for Ford. Until then, he’s continuing to make progress on restructuring actions and business deals such as a partnership announced earlier this week with Google for cloud services and in-car infotainment.

“2021 is our year of action,” Farley told CNBC during an interview. “We’re executing our plan and we’ll continue to do that so every business in our portfolio has a sustainable future. If not, we will restructure it.”

Since becoming CEO on Oct. 1, he’s been building upon and “accelerating” an $11 billion restructuring plan launched under his predecessor in 2018 that Farley helped design as Ford’s second in command. It has so far included slashing global headcount by 14,000 people, restructuring operations globally and ending vehicle production in Brazil, among other things.

EVs

But Wall Street wants more from Ford, specifically regarding its plans for EVs. The company’s largest crosstown rival, General Motors, has won praise for its restructuring and bold new EV vision.

GM CEO Mary Barra has been steadily pulling the automaker out of unprofitable markets since taking over the company in 2014. GM exited markets such as Australia, Russia and Europe. In 2018, GM restructured its North American operations, including job cuts and plant shutdowns, to refocus the 112-year-old automaker on emerging technologies, such as electric and autonomous vehicles.

GM has promised 30 new EVs by 2025 under a $27 billion investment plan in electric and autonomous vehicles. Just last week, the company announced “aspirations” to discontinue making gas-powered vehicles by 2035.

Whereas Ford, by comparison, is now evaluating overseas markets and has pledged $11.5 billion in investments in “electrified” vehicles through 2022, including hybrid and plug-in hybrid vehicles, which Farley characterized as transitional technologies for the company.

“I don’t have any regrets about that decision but if you’re asking about the future, and being specific about the future, on what our mix is going to be, and how it’s going to change, yes our mix is definitely changing to pure battery electric,” Farley said. “I’m not going to go into details today. Stay tuned.”

The difference has been reflected in the companies’ share prices. Since 2018, GM’s stock has risen 32.4% to $54.25 a share while Ford’s has fallen 10.3% to $11.20 a share. That’s given GM a market value of $77.6 billion — almost double Ford’s at $43.8 billion.

Then-Ford CEO James Hackett (3rd R) and team members, including his successor, Jim Farley (3rd L), reveal the company’s first mass-market electric car the Mustang Mach-E, which is an all-electric vehicle that bears the name of the company’s iconic muscle car at a ceremony in Hawthorne, California on November 17, 2019.

Mark Ralston | AFP | Getty Images

Currently, Ford’s only all-electric vehicle in the U.S. is the Mustang Mach-E, which was built new from the ground up. The company has announced plans to electrify its most well-known nameplates such as an upcoming F-150 EV as well as its Transit van, which is highly important to the company’s commercial business.

Farley’s also focused on launching new products such as the Mach-E and the highly anticipated Bronco SUV this summer — without any significant problems. Some previous launches haven’t gone so smoothly and resulted in staggering warranty costs for the automaker.

“The team is doing a better job launching and the financial performance is more reliable and we’re getting serious about restructuring where we need to. Those are all great things,” Farley said. “But that’s the beginning. The most important transformation of Ford is the modernization and disruption of our company, and they’re different things.”

Thus far, Farley is off to go a great start. Ford stock recovered 60% through his first four months as CEO, led largely by optimism about his leadership and restructuring actions. That compares to a more than 60% decline in the company’s stock during the tenure of Ford’s last two CEOs from July 2014 through October 2020.

Two clocks

Credit Suisse analyst Dan Levy has referred to automakers’ battle between investing in their profitable core businesses and unprofitable, yet emerging, new technologies as “near” and “far” clocks. Both must be properly on time for a company like Ford to be successful and appease investors.

In many ways, Ford’s clocks have been out of synch in recent years. It had a car-heavy lineup and outdated SUVs as the industry transitioned to utility vehicles and its global restructuring lagged GM, which has given it an edge with investors.

“We see GM as better positioned in a transition to EV/better balancing of the ‘Two Clocks’, while for Ford conversely we see more challenges ahead in the transition to EV,” Levy wrote in a note to investors Tuesday. “That said, both companies should be beneficiaries of a solid cycle environment, with Ford offering opportunity as new CEO Jim Farley lays out a new agenda.”

Ford unveiled its new all-electric Transit van on Nov. 12, 2020.

Ford

Morgan Stanley analyst Adam Jonas last week downgraded Ford to underweight — two months after his last downgrade of the company. He said GM has greater potential than Ford to be successful in profitably shifting from a business built on vehicles with traditional internal combustion engines, or ICE, to EVs.

“We firmly believe that with successful execution, Ford can benefit from many of the same drivers of upside that we currently reflect in our GM price target,” he wrote in a note to investors. “We believe Ford CEO Jim Farley has an opportunity to leverage Ford’s strengths in EV manufacturing while mitigating the risks of ICE exposure in the years to come.”

Jonas said the recently released Mach-E is a good example of the company’s EV tech, but the “path to scale is where we would like to see greater proof points.”

‘Incredibly profitable’

Farley plans to deliver such proof soon: “We can be incredibly profitable. Profitability that the company’s never seen in our history. Just in the traditional auto business,” he said. “And then to modernize and disrupt the company, I’m not going to come out of the chute and explain all that in the first three months as CEO. That’s not a smart thing to do.”

Ford’s announcement with Google earlier this week was well-received by Wall Street, sending the company’s stock price up as much as 8.6% during intraday trading on Monday. Morgan Stanley estimated the tie-up could create an annual revenue stream of $9 billion and generate $5 billion in profit for the automaker.

Jim Hackett, president and chief executive officer of Ford Motor Co., right, speaks as Jim Farley, president of global markets, stands next to a 2020 Ford Motor Co. Explorer sport utility vehicle (SUV) during a reveal event in Detroit, Michigan, U.S., on Wednesday, Jan. 9, 2019.

Jeff Kowalsky | Bloomberg | Getty Images

Farley’s predecessor, Jim Hackett, was criticized by many for a lack of urgency and transparency with investors as well as overly theoretical or philosophical goals internally. Those are things Farley, known as an intense, direct and driven person, plans to avoid.

“We’ve been busy redoing things, now we’re accelerating them,” he said. “The company appreciates a clear plan. They don’t like ambiguity.”

As of the third quarter of last year, Ford was less than halfway through its $11 billion restructuring that was initially announced as a five-year plan in 2018. The company last month said it was ending manufacturing in Brazil as part of the plan, which would result in $4.1 billion in pretax charges, including $2.5 billion in cash.

Ford is set to report its fourth-quarter and year-end earnings Thursday after the market closes. As of Wednesday, average estimates of 15 analysts compiled by Refinitive expect Ford to report a fourth-quarter loss of 7 cents a share and $33.89 billion in revenue, a 7.6% decline compared with a year earlier.

“I’m really proud of the team. I love our new team. I love our plan, and I can’t wait for our team to perform financially so that we can fund this growth, and even literally disrupt ourselves,” he said. “I also can’t wait to explain kind of the whole thing. It takes a little time … but 2021 is the year.”