The beauty industry is expected to be worth over US$430 billion by 2026, estimates alone show that beauty and personal care products’ US market value is over US$93 billion. The number is expected to rise further if it’s not for the sudden onset of the coronavirus that has plagued the world since the start of 2020. While this unexpected once in a generation crisis has severely altered the way most people have lived their lives, it has also conferred greater urgency for society to arm themselves with knowledge. The internet is a treasure trove of information, where with a click of a button, a person could gain insights into a particular topic.

Equipped with such knowledge has made shopping for products easier, faster and somewhat personalised. In this seemingly over-saturated market, where each brand maintains its own speciality, it’s easy to think it’s all been done. As long as the product contains that “magical ingredient” that you are looking for, you will buy it—that easy. Reports have shown that catering to the mass market is no longer as profitable compared to the past. Diversity is an important consideration that brands have to keep in mind when developing their new products.

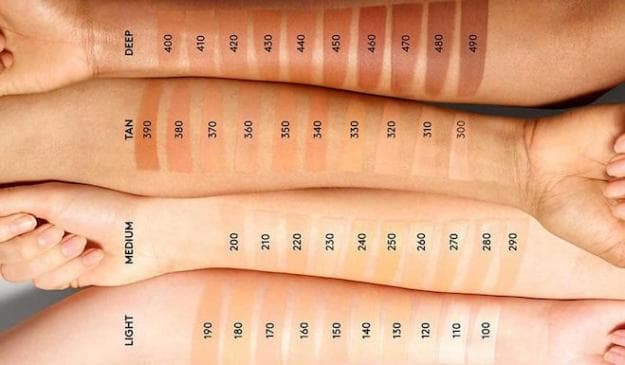

When Fenty Beauty first launched in 2017, it released a whopping total of 40 shades of foundation and this became a clarion call for many other brands to recognise that inclusivity should be standard, and individuality and self-expression celebrated. The beauty industry soon recognised the need for products and services that could relate more closely to the consumers. To address this gap in bespoke skincare, more brands are seeking to capitalise on this increasing demand. By converging technology, data, and e-commerce, these elements combine to allow brands to engineer the perfect products that are customised to an individual’s needs, and all from the comfort of their own home.

A typical consumer journey begins with researching the skin type and conditions that we wish to treat, and the knowledge online helps with zeroing in on which products are suitable. Herein lies another problem for many, the vast array of brands which claim similar efficacy in the market means that consumers can easily feel overwhelmed and confused about finding the right products. Having a one-to-one consultation is of course the best way to have a tailored treatment that addresses whatever concerns that a consumer might have but in light of the current pandemic, it is more arduous to seek advice in stores.

Female consumers usually have an easier time picking up beauty products as many are formulated with this demographic in mind. According to beauty site Byrdie, women in the US spend around US$3,756 on their appearance annually and this translates into around US$225,360 through their entire lifetime. On the other hand, men spend only US$175,680 during their lifetime on health and beauty products. This represents an untapped portion of the market that is underserved, as men grooming is usually promoted as a blanket category.

A major pushing factor for the rise of the customised beauty trend is the changing consumer preferences and behaviours. Reports have shown that Millennials and Gen Z spenders have a different relationship with brands and this extends to their beauty needs. They use their consumption as a form of expression and individual identity while also considering the wider social impacts it may have as well. As these spenders will form the bulk of beauty brands’ consumer group, it is important that the concerns of this group are addressed. One-size-fits-all products no longer work as each person has unique needs.

To address the concerns and adapt to current times—new innovations are created to help with personalising skincare and makeup products. For example, MAC cosmetics has an online foundation shade finder that consumers can use to determine the best shade. This is helpful for consumers as testers may not be available when due to pandemic. Using AI technology, the makeup brand is able to recommend the right foundation. Bringing the use of technology to the next level is Swedish brand Foreo, their latest product the LUNA fofo uses its embedded sensors to analyse the skin to create personalised recommendations that can be accessed using their mobile application. Through machine learning, when the device is used daily, it is better able to fine-tune its recommendations.

Lastly, as mentioned, blanket solutions no longer satisfy the new generation of consumers. Understanding this new trend is Skin Inc, a skincare brand from Singapore. “Customisation didn’t exist when we started the business,” said founder Sabrina Tan in an interview. “By launching the world’s first supplement bar and customised cocktail serum with the ability to fit up to 10 active ingredients for a personalised touch, we set the bar for innovation in one of the most competitive categories in beauty.” Responding to the needs of the consumer, the brand has over 60 data-driven formulations and utilising this knowledge has enabled it to create targeted formulations. Similarly, haute perfumery maker Maison 21G also employed the use of technology to help its consumers personalise their fragrance.

More than just personalisation, what consumers are also looking for is preservation and even better formulations. Given that more information is constantly being collated, brands can take the chance to look over the data, scrutinise the findings and upgrade their products. As the world of beauty becomes increasingly competitive, it is pertinent that brands are able to distinguish themselves. Simplifying the process of finding the right product and taking lead in consultation will encourage consumers to be more loyal to the brand. Harnessing the power of technology can enable brands to be heard in the changing buyer habits and ultimately, it will help to pump up a brand’s profit.