A pair of space companies received delisting warnings on Friday, according to securities filings, as both ventures’ stock prices stood below $1 a share.

Small satellite builder and data specialist Spire Global received a notice from the New York Stock Exchange, while spacecraft delivery company Momentus received a notice from the Nasdaq.

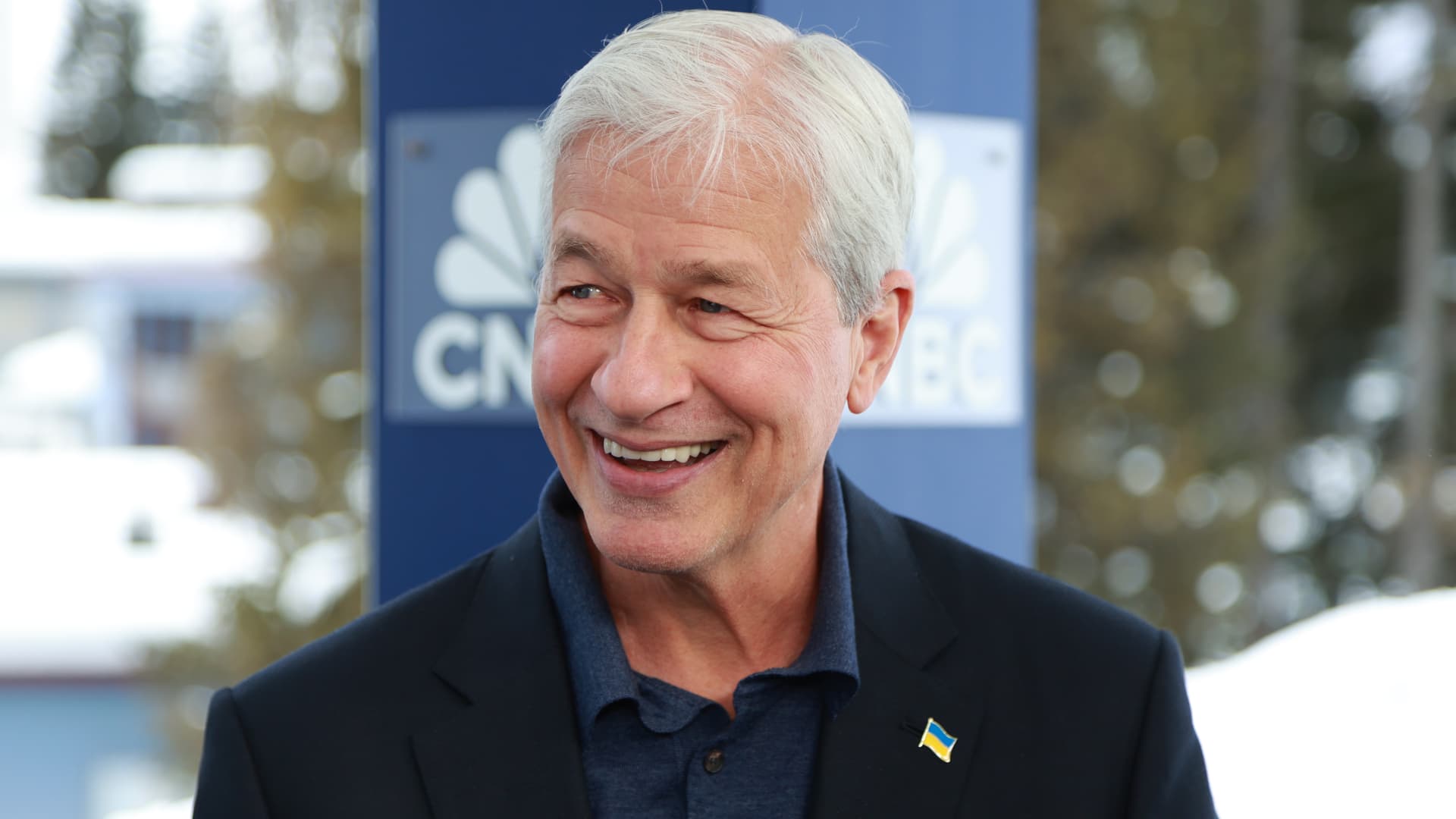

related investing news

Under the respective exchanges’ compliance rules, the companies have 180 days, or about six months, to get their stock prices back above $1 a share.

Spire’s stock closed at 69 cents a share on Friday, having first slipped below $1 a share on Mar. 7.

Momentus’ stock closed at 63 cents a share, slipping below $1 a share on Feb. 7.

Both companies noted the possibility of conducting a reverse stock split to regain compliance.

Spire debuted on the public markets in August 2021, after completing a SPAC merger. The company hit $100 million in annual subscription revenue, it announced during its Q4 results, and has continued to shave its losses as it aims to be free cash flow positive in about a year.

Momentus also debuted in August 2021, following its own SPAC merger. After a turbulent leadership changeover, the company has struggled to ramp up its spacecraft platform business. In Q4, it saw minimal revenue, but hopes to fly multiple missions this year.

The warnings come as fellow space company Astra seeks an extension from the Nasdaq to regain compliance after it received a delisting warning last year.