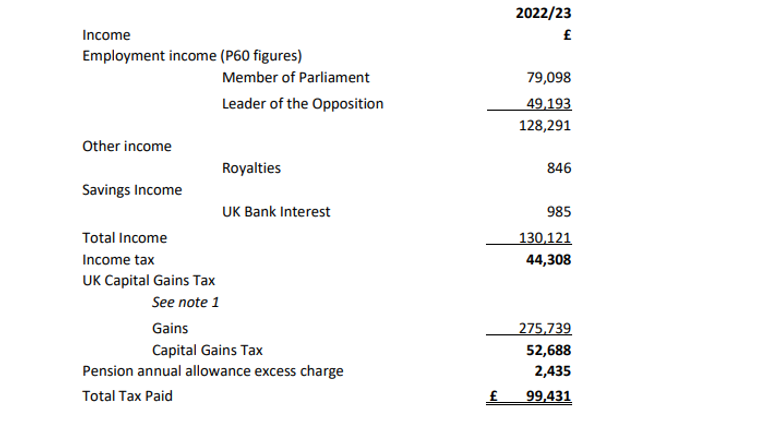

Sir Keir Starmer paid £99,431 in tax last year, according to a summary released by the Labour Party.

The release, published on Friday, showed that the Labour leader paid £44,308 in income tax in 2022/23.

He also paid £52,688 in capital gains tax following the sale of a field in December 2022 partly owned by himself and partly owned by his father’s estate.

The total is more than the £67,033 he paid to HMRC for the 2021/22 financial year

The documents also show the Labour leader earned £128,291 in his capacity as an MP and the leader of the opposition.

Sir Keir published the details after Rishi Sunak published his personal tax return last week, showing he paid more than £500,000 in UK tax last year, as his total income rose to £2.2m.

Politics live: Backbench Tories deliver message to Rishi Sunak after double by-election defeat

The summary of the prime minister’s financial affairs was made public as parliament was in recess.

The document shows he paid a tax bill of £508,308 in the financial year 2022-23 – around £75,000 more than what he paid in the previous year.

Mr Sunak made nearly £1.8m through capital gains – up from £1.6m in 2021/22 – as well as £293,407 in other interest and dividends.

All of the investment income and capital gains came from a US-based investment fund listed as a blind trust, according to the summary.

He also earned £139,477 from his roles as an MP and prime minister.

Mr Sunak first said he would publish his tax returns during his unsuccessful campaign to be Tory leader against Liz Truss in the summer of 2022.

The prime minister is thought to be one of the richest MPs in parliament and Labour has long used his personal wealth to argue that he is “out of touch” with the concerns of ordinary voters.

According to 2023’s Sunday Times Rich List, Mr Sunak and his wife, Akshata Murty, the daughter of the billionaire co-founder of Indian IT giant Infosys, have a combined wealth estimated at about £529m.

Read more:

Chancellor looking to cut public sector spending to lower taxes, Sky News understands

Capital gains tax: What is it, when do you have to pay it and when are you exempt from it?

Pressure about their finances started piling on Mr Sunak while he was chancellor, after it emerged Ms Murty had non-dom status – meaning she did not have to pay UK tax on her international income.

Following a significant backlash, Ms Murthy announced she would pay UK tax on all her worldwide wealth to stop the issue from acting as a “distraction for her husband”.

However, the calls for the prime minister to release his tax details then grew louder following the controversy around Nadhim Zahawi, who was sacked as Tory Party chairman in January 2023 after he failed to disclose millions of pounds in tax.