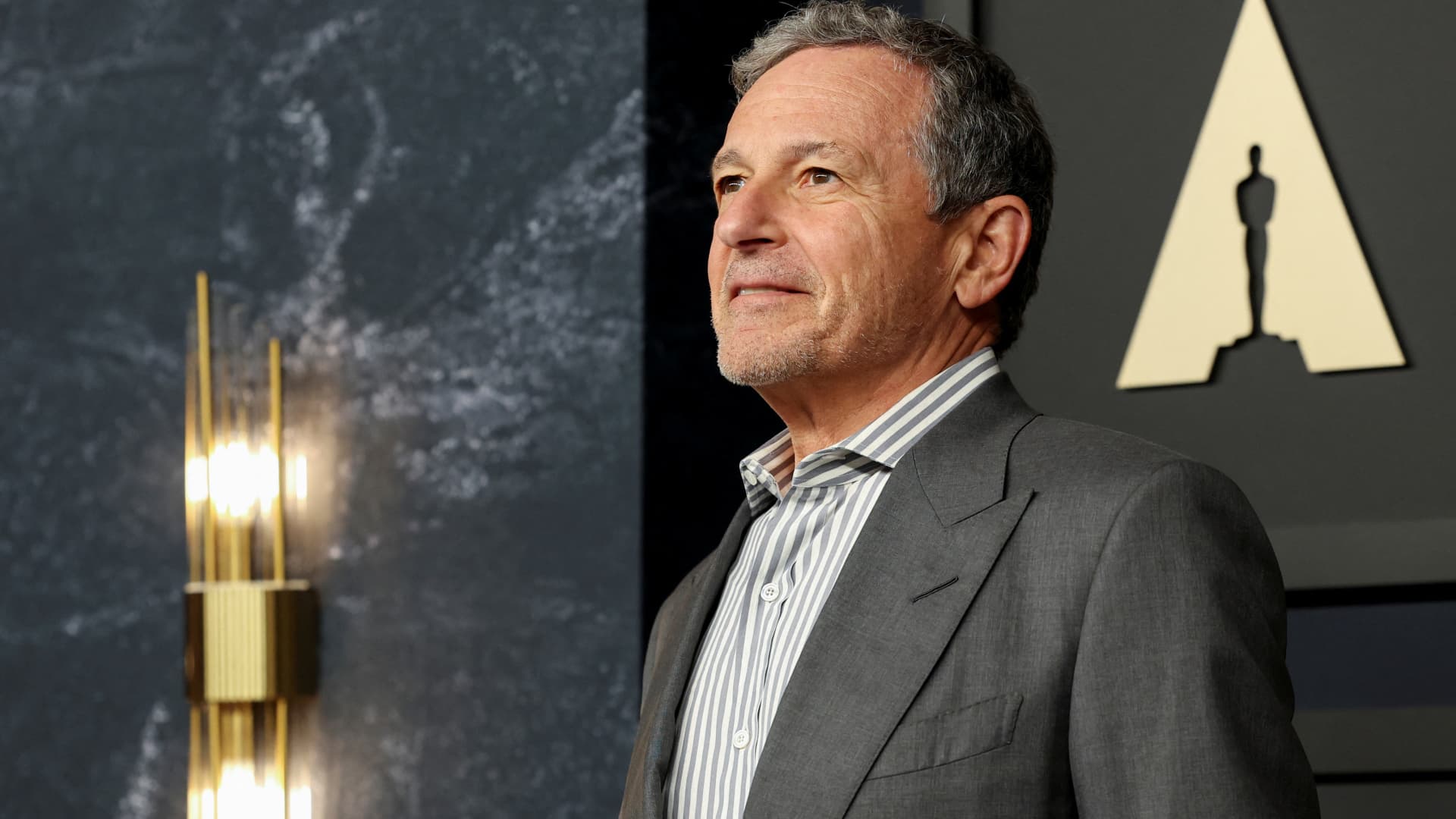

The Walt Disney Company CEO Bob Iger attends the Nominees Luncheon for the 95th Oscars in Beverly Hills, California, U.S. February 13, 2023.Â

Mario Anzuoni | Reuters

For Disney, the future is now.

It’s been five years in the making, but Disney nearly turned a profit in its streaming units for the first time in the second quarter, losing just $18 million between Disney+, Hulu and ESPN+. That’s improvement from a loss of $659 million a year ago.

Stripping out ESPN+, Disney+ and Hulu actually made money in the quarter â $47 million. Last year in the second quarter, Disney+ and Hulu lost $587 million.

The thesis among all major legacy media companies has been that streaming will eventually take over for cable TV as the primary money-making engine. That’s why Disney, Paramount Global, Warner Bros. Discovery and Comcast‘s NBCUniversal all built their own subscription streaming services.

That hasn’t happened yet, but this quarter finally suggests that moment is upon us. It’s not just that Disney nearly made money in streaming â it’s that the company’s traditional linear TV results were awful.

For years, Disney held back on making ESPN available outside of the cable bundle because of how lucrative the sports network was inside the walled garden of traditional TV. Those days are also nearly over. Disney is launching a skinnier bundle of linear cable channels with Warner Bros. Discovery and Fox in the fall, making ESPN available outside of traditional cable for the first time. Next year, Disney will launch its flagship ESPN streaming service, which will allow consumers to subscribe to ESPN without cable at all.

Looking at Disney’s results in the second quarter, it’s clear why the company has finally pulled the ripcord on ESPN. While ESPN’s revenue rose 3% to $4.21 billion, operating income dropped 9% to $799 million. Lower advertising revenue, a drop in cable subscribers, and higher programming costs attributable to the College Football Playoff led to the decline, Disney said.

The decline in the company’s other linear networks, such as ABC, Disney Channel, FX, National Geographic, and Disney Junior, was even more alarming. Linear network revenue across Disney’s portfolio, excluding ESPN, fell 8% to $2.77 billion. Operating income slumped a whopping 22% to $752 million.

Disney shares fell 5% in premarket trading.

The new reality

Simply put, traditional TV is dying on the vine. It’s declining at the most rapid pace consumers have seen.

Disney has prepared for this moment for years. Streaming will become profitable in the fourth quarter, Disney reiterated, and will “be a meaningful future growth driver for the company, with further improvements in profitability in fiscal 2025,” the company said in its earnings release.

The big question for the company is if its investors will embrace this new reality. That will be up to Disney’s streaming execution in the years to come, and likely, Chief Executive Officer Bob Iger’s still to-be-named successor.

Disclosure: Comcast’s NBCUniversal is the parent company of CNBC.

WATCH: Disney earnings top analyst estimates as streaming nearly breaks even in the quarter

![Scream 7 Trailers Are Making Me Think [SPOILER] Has To Be The Killer Scream 7 Trailers Are Making Me Think [SPOILER] Has To Be The Killer](https://cdn.mos.cms.futurecdn.net/SB3efVqBwkiQ9NbuDBsTq8-1280-80.jpg)